What is carbon capture?

Carbon dioxide (CO2) emissions generated by human activities have led to an accumulation of greenhouse gases in the atmosphere that is causing an increase in

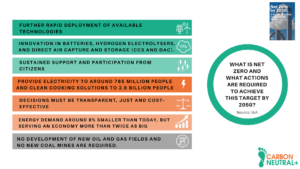

According to World Bank data, only 56% of the world’s population and 68% of economies are committed to reaching zero emissions by 2050.

This is why many public and private organizations participate in the fight against climate change. One of the mechanisms used by these organizations is related to the price of carbon, also called carbon pricing.

In this article, we will discuss the concept and current status of the price of carbon. The latter represents the price set internally by companies to manage and develop decarbonization strategies.

What is the price of carbon?

The price of carbon is the price of emitting greenhouse gases into the atmosphere. It is an economic thermometer that quantifies the costs of the environmental damages caused by the operations of different industries. Its main objective is to lead the way towards a low-emission economy.

Many countries have established carbon taxes or an Emissions Trading Scheme (ETS).

What is an ETS?

An ETS (Emissions Trading System) is a system that sets a limit and a price on GHG emissions. The goal is that those companies/industries that generate emissions below the established limit can sell their units to other entities as carbon credits at a carbon price previously established by the market.

In LATAM, Mexico is already piloting an ETS. It is expected to be 100% effective by 2023. Colombia and Chile are in the process of analyzing and setting up an ETS in the short term.

Companies quantify their environmental impacts through the internal price of carbon based on a monetary value. This allows them to transform their activities and reduce their emissions or assume the associated costs.

Why is it important to establish a price of carbon?

Value creation is the primary goal of businesses, but there is no value without sustainability.

Internal carbon pricing emphasizes incorporating additional factors into the monetary value analysis. Some of the main benefits of carbon pricing are:

According to a recent World Bank report,

“We are at a unique moment where setting a price of carbon can contribute to a resilient, inclusive, and sustainable post-pandemic recovery and help countries pursue a low-carbon growth path.”

How does a company set an internal price of carbon?

Below are some of the most commonly used internal carbon pricing methodologies and instruments:

What is the price of carbon?

According to a World Bank report, currently (2021), the average carbon price is around US$ 2 per ton of CO2 equivalent emitted.

However, according to the Stern/Stiglitz Commission, to meet current decarbonization targets, the price should rise to between US$50 and US$100/tnCO2eq by 2030.

According to the International Energy Agency, to meet the Paris agreement targets, the carbon price should:

According to the 2021 CDP report, the average internal carbon price used by companies is U$S 25/tnCO2eq. And its maximum value is US$ 200.

As it can be seen, different sources generally report different values. This is because the price set depends on the calculation method used and the companies evaluated in the sample.

Which companies use carbon pricing?

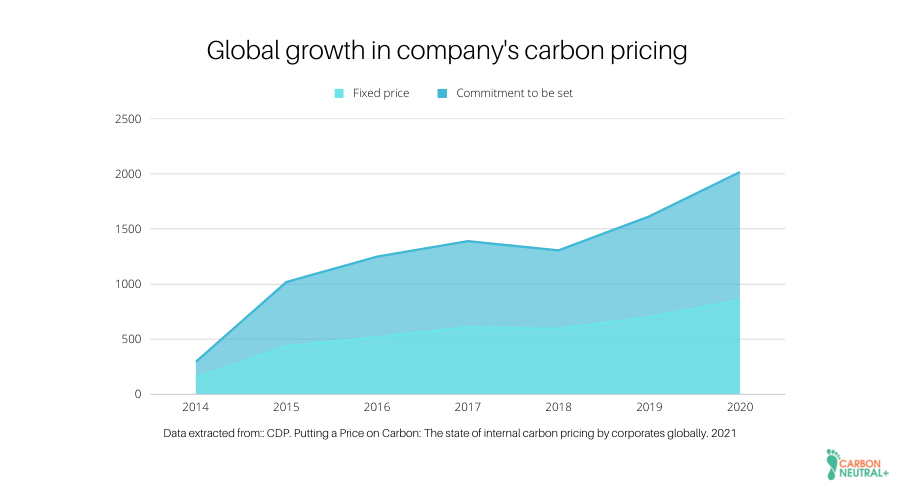

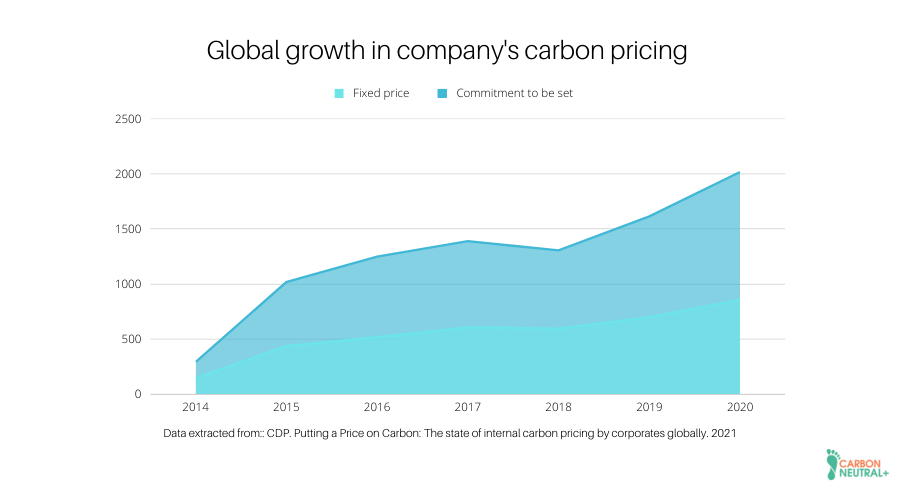

According to the CDP 2021 report, more than 2,000 companies use the price of carbon or internal carbon pricing. These include more than 100 Fortune 500 companies that use or plan to use it.

This number represents a 54% increase over the companies surveyed in 2017. The financial industry is the biggest driver of this growth.

The following graph represents the growth in the price of carbon over the last decade:

Conclusions

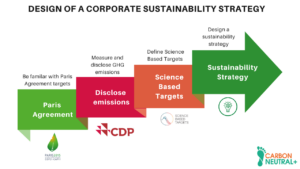

Internal carbon pricing is a tool increasingly used by companies and investors. Its main goal is to define and evaluate its business strategies based on its carbon emissions.

In addition to this tool, there are other actions you can take today to reduce your company’s environmental impact.

If you are looking to set your reduction targets based on SBT, Carbon Neutral+ can help you

Among the services offered by CARBON NEUTRAL+, two of them that are useful for companies that want to apply to this increasingly important initiative: the carbon footprint measurement performed under the GHG Protocol standards (approved by SBTi), and the operation with renewable energies through BIOREC+. These will allow them to reduce their carbon footprint scope 2 and thus add points and be aligned to multiple reduction targets.

If you want your company to be part of SBTi, contact us and we’ll reply as soon as possible to find the best way to add points and set carbon reduction goals.

References

CDP. Putting a Price on Carbon: The state of internal carbon pricing by corporates globally. 2021

Banco Mundial. Liderazgo en la fijación del precio del carbono en 2020-21. 2021

Parlamericas. Manual sobre la fijación del precio del carbono.

Carbon dioxide (CO2) emissions generated by human activities have led to an accumulation of greenhouse gases in the atmosphere that is causing an increase in

According to the Emissions Gap Report 2022, the growth rate of global greenhouse gas (GHG) emissions has declined over the last decade. Between 2010 and

As international agreements related to corporate greenhouse gas emissions (GHG) come into force, the regulations associated with the generation of these emissions increase. This is

Climate change is one of the greatest concerns of our time. This phenomenon is generating consequences that are difficult to reverse, such as an increase

The Paris Agreement is an international agreement adopted on December 12, 2015 during the United Nations Climate Change Conference (COP21) in Paris, France. One of

As the world faces the looming effects of climate change, more and more companies are recognizing the importance of adopting sustainable strategies that aim to

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |