What is carbon capture?

Carbon dioxide (CO2) emissions generated by human activities have led to an accumulation of greenhouse gases in the atmosphere that is causing an increase in

As international agreements related to corporate greenhouse gas emissions (GHG) come into force, the regulations associated with the generation of these emissions increase. This is where the emission trading systems are born.

The emission trading system refers to government regulation that forces companies to reduce their GHG. This is achieved through setting a cap on emissions and the obligation for companies to offset any excess through the purchase of emission allowances.

In this article, we will tell you how the emission trading system works, countries and regions that currently implement it, which productive sectors are affected and what are the benefits of such policies for our planet.

The emission trading system works by assigning a GHG emissions cap to companies. In the event that companies exceed this cap, they are required to purchase allowances to offset any excess emissions. In addition to this, these regulations set emission reduction targets and require companies to meet certain standards year after year.

The emission trading system can take different approaches. The most common is the cap and trade system, where companies are assigned an emissions cap and allowed to buy and sell allowances. Another mechanism is carbon tax systems, where companies are taxed based on their carbon emissions.

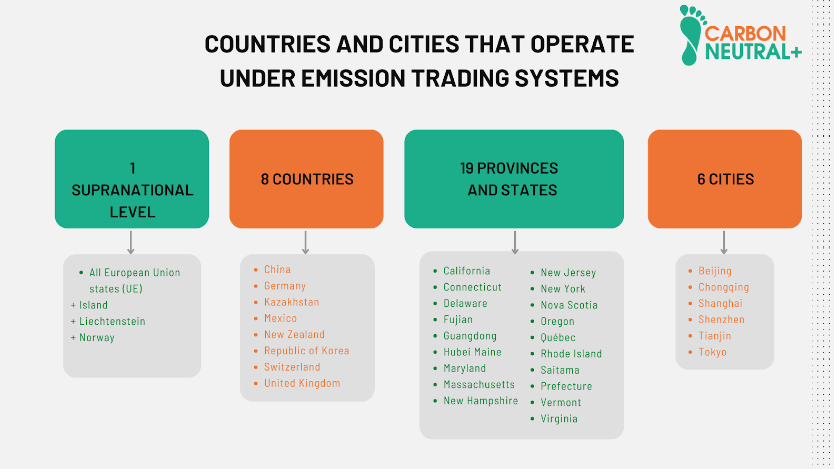

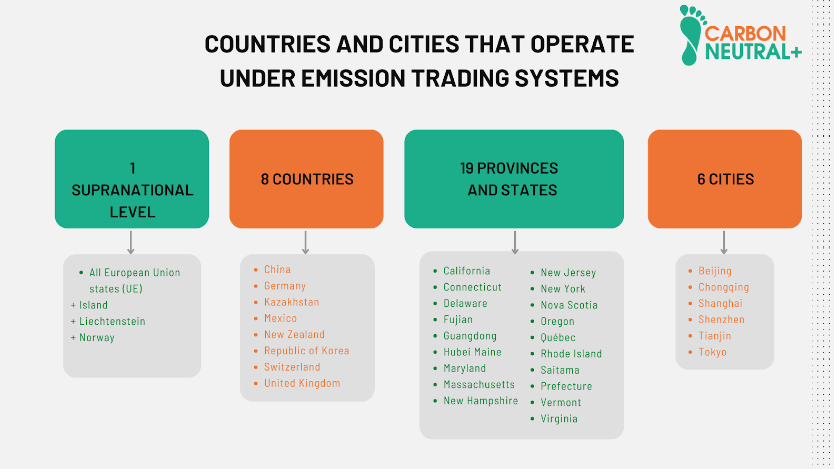

According to the latest report from the International Carbon Action Partnership (ICAP), there is great complexity regarding the level of governance of these markets. Currently, mandatory carbon crediting systems are implemented for:

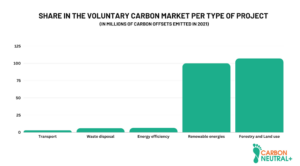

The following chart shows the distribution of these markets:

In turn, emission trading systems cover:

The EU ETS (European Union Emissions Trading System) operates on the principle of “cap and trade”.

This principle is based on setting a limit on the total amount of certain greenhouse gases that can be emitted by operators covered by the system. The limit is modified over time with the aim of reducing total emissions in the region.

Within that cap, companies purchase emission allowances that they can trade among themselves if they exceed the amount of GHG emissions allowed by the market over the course of a year.

At the end of each year, an operator must deliver enough allowances to fully cover its emissions; otherwise, it is subject to heavy financial penalties. If an installation generates fewer emissions than the limit, it can either keep the excess allowances to cover its future needs or sell them to another operator that requires additional allowances.

Revenues from the sale of allowances in the EU ETS go mostly to the budgets of the Member States. Emission allowances are also auctioned to feed funds that support innovation in low-carbon and energy transition technologies.

The EU ETS covers the following productive sectors and GHGs:

The Regional Greenhouse Gas Initiative (RGGI) is the first mandatory U.S. emissions trading program to limit carbon dioxide emissions from the electricity sector.

Currently, there are eleven states currently participating in RGGI:

RGGI was created in 2005 and generated its first auction of CO2 allowances in 2008.

Average annual CO2 emissions from RGGI electric generation sources decreased by 48% between the 2006-2008 base period and the 2016-2018 period (these statistics do not include New Jersey, which rejoined RGGI in 2020).

States have set a goal of further reducing emissions 30% below 2020 levels by 2030.

Between 2009 and 2017, RGGI states have realized a net economic benefit of $4.7 billion from the emissions trading program.

The Korean Emissions Trading System (KETS), launched in 2015, covers about 66 % of Korea’s total GHG emissions. It is the first mandatory emissions trading system among non-Annex I countries of the UNFCCC.

The KETS could trigger the expansion of emissions trading among emerging economies and Asian developing countries. The European Commission is supporting Korea through a technical assistance project focused on building capacity to implement the KETS.

New Zealand Emissions Trading Scheme (NZ ETS) helps reduce domestic emissions through three main measures:

The Government sets and reduces the number of units supplied to the scheme over time. This limits the amount of GHGs that companies can emit, in line with New Zealand’s emissions reduction targets.

Companies participating in the NZ ETS can buy and sell units from each other. The price of units reflects supply and demand in the scheme. This price signal allows companies to make economically efficient decisions on how to reduce emissions.

All sectors covered by the NZ ETS must report their annual GHG emissions to the government. The sectors included within New Zealand’s emissions trading scheme are:

The emission trading system has experienced significant growth in recent years, driven by growing concern about climate change and the global need to reduce GHG emissions.

According to the latest ICAP report, the percentage of global GHG emissions subject to an emission trading system has tripled since 2005.

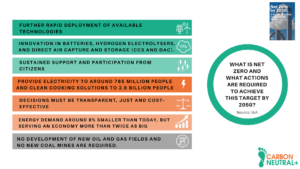

All IEA scenarios in its Net Zero scheme, which limit global warming to 1.5 degrees, include the use of Carbon Dioxide Removal (CDR) approaches. CDR involves capturing atmospheric CO2 and storing it permanently. The balance between emission reduction and removal, as well as the degree of CDR utilization, varies depending on the scenario.

Allowing the use of credits generated from CDR processes in emissions trading in domestic and international markets could generate positive financial flows and increase demand for carbon sequestration services.

In domestic markets, experience with CO2 removal is, in general, limited to nature-based solutions. These are typically forestry offsets generated under strict methodologies. However, ICES sees the inclusion of carbon capture practices within the mandatory emissions market as a possibility that could bring us closer to Net Zero.

In summary, the emission trading system is a globally implemented tool that puts a cap on the amount of emissions that a company can generate over the course of a year. Such markets have been implemented in a total of 8 countries and 1 Supranational region (EU).

Emission trading systems have several benefits, such as reducing companie’s GHG emissions, financing the development of clean technologies, and creating green jobs from these technologies.

As more countries adopt emission trading systems, the carbon market is expected to continue to grow. Ultimately, emission trading systems are a tool to regulate corporate GHG emissions and its effectiveness in reducing emissions has been proven over the past 20 years.

CARBON NEUTRAL+ provides comprehensive solutions to measure, reduce and offset carbon emissions through its carbon footprint management platform. In addition, it accompanies companies in the implementation of emission reduction strategies, identifying energy efficiency opportunities and offsetting remaining emissions through verified carbon projects. Together with CARBON NEUTRAL+, companies can demonstrate their commitment to sustainability and lead concrete actions against climate change.

Contact us to get started on the road to carbon neutrality!

Carbon dioxide (CO2) emissions generated by human activities have led to an accumulation of greenhouse gases in the atmosphere that is causing an increase in

According to the Emissions Gap Report 2022, the growth rate of global greenhouse gas (GHG) emissions has declined over the last decade. Between 2010 and

As international agreements related to corporate greenhouse gas emissions (GHG) come into force, the regulations associated with the generation of these emissions increase. This is

Climate change is one of the greatest concerns of our time. This phenomenon is generating consequences that are difficult to reverse, such as an increase

The Paris Agreement is an international agreement adopted on December 12, 2015 during the United Nations Climate Change Conference (COP21) in Paris, France. One of

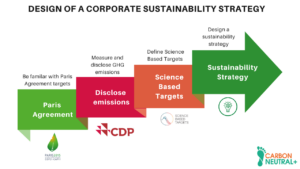

As the world faces the looming effects of climate change, more and more companies are recognizing the importance of adopting sustainable strategies that aim to

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |