What is carbon capture?

Carbon dioxide (CO2) emissions generated by human activities have led to an accumulation of greenhouse gases in the atmosphere that is causing an increase in

According to the Emissions Gap Report 2022, the growth rate of global greenhouse gas (GHG) emissions has declined over the last decade. Between 2010 and 2019, the average annual growth in GHG emissions was 1.1%, down from 2.6% between 2000 and 2009.

According to this UN report, the mitigation plans of the countries that signed the Paris Agreement are not enough to prevent the Earth’s average temperature from exceeding a 1.5°C temperature increase over pre-industrial levels. In fact, if efforts are not deepened, it is estimated that in the 21st century the temperature will rise between 2.6°C and 2.4°C.

In this context, the voluntary carbon market has emerged as a complementary tool to the emission trading system. The main goal of the voluntary market is that individuals and companies can offset their carbon dioxide (CO2) emissions through the financing of projects that capture or reduce a certain amount of GHG emissions.

In this article, we will tell you what the voluntary carbon market is, and we will also explore its beginnings. In turn, we will tell you what actors participate in this system, what milestones mark its recent evolution and some interesting cases to highlight in LATAM.

The history of the voluntary carbon market

The voluntary carbon market (VCMs) emerged in the late 1990s. They were born as a response to the need to reduce GHG emissions, going beyond the commitments established by the Kyoto Protocol for mandatory reduction by the most developed countries at that time.

The Kyoto Protocol was an international treaty that established binding emission reduction targets for developed countries. However, it did not include specific regulations for non-governmental actors and left out smaller-scale CO2 sequestration projects.

In this context, the voluntary carbon market has developed as a way for companies, organizations and individuals to offset their carbon emissions. This is achieved through the financing of projects that capture or generate a reduction in GHG emissions from different cities and nations activities around the world.

Carbon offset projects aim to generate real and additional emission reductions. Along with these, parallel certification systems have emerged with validated standards and methodologies that guarantee their transparency and integrity.

Carbon credits are issued, sold and bought. Each credit represents the reduction, elimination or sequestration (biological or technological) of 1 ton of carbon dioxide equivalent (CO2eq). When a credit is used for this purpose, it becomes an offset. Once it’s used, it is transferred to a registry of retired credits, and is no longer tradable.

From the Carbon Neutral + website, you can offset your emissions through the purchase of credits that finance REDD+ projects. To learn more, we invite you to visit our Marketplace.

Who participates in the voluntary carbon market?

The voluntary carbon credit market is made up of the following actors:

Project developers work to produce carbon credits for other sectors or industries.

There are different types of initiatives that produce carbon offsets. These include:

If you want to learn more about the different types of carbon credits that exist in the voluntary market, we recommend you read our article “What are carbon credits and how do they work?”

This group includes private companies, NGOs, governments, universities and any individual who purchases carbon credits from producers.

By purchasing carbon credits on the voluntary market, a company can offset its Scope 1, 2 and 3 corporate carbon footprint, product carbon footprint and/or events carbon footprint.

These organizations verify that a project meets the emission reduction targets set by the project developer.

There are two types of certificates. On the one hand, those that implement quantitative environmental benefit measurement methods.

There, only emissions reduced or eliminated from the atmosphere are accounted for. Among them are: VCS, Gold Standard, Climate Action Reserve, American Carbon Registry and CDM.

If you want to learn more about this topic, we recommend you to read our article on standards in the voluntary carbon credits market, which you can find in this link.

On the other hand, qualitative certificates allow the co-benefits of the projects to be valued.

Co-benefits are all the additional benefits, whether social, environmental or economic, that are obtained beyond the reduction of GHG emissions in a project.

Examples include community development through education, access to basic services, employment generation and local capacity building. In addition, the conservation of biodiversity and other resources, such as water and air, are considered environmental co-benefits.

Voluntary carbon markets today

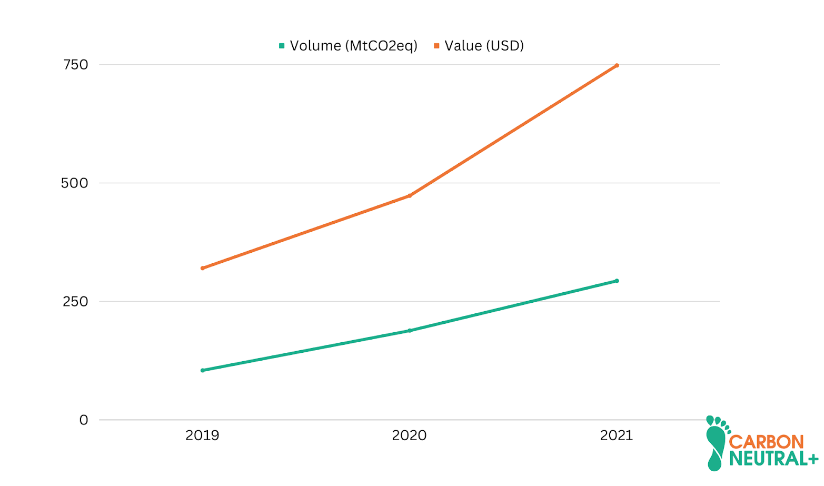

According to the State of the Voluntary Carbon Markets report, published in 2022 by Ecosystem Marketplace, prices and volumes traded in the voluntary carbon credit market continue to grow steadily.

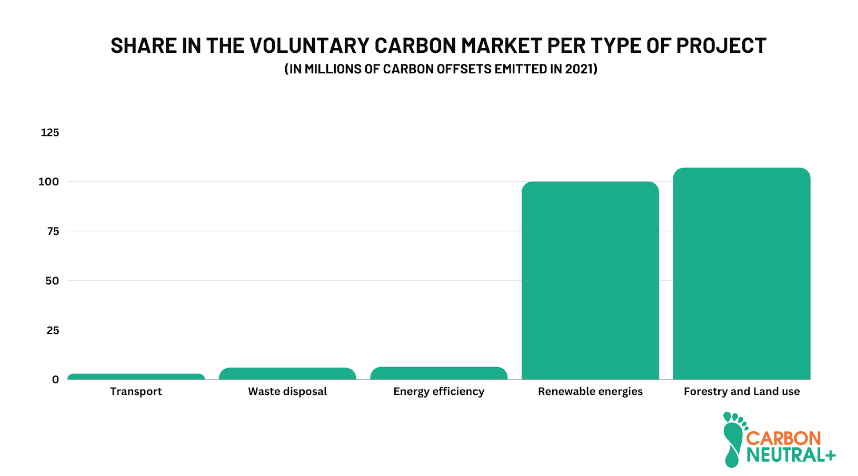

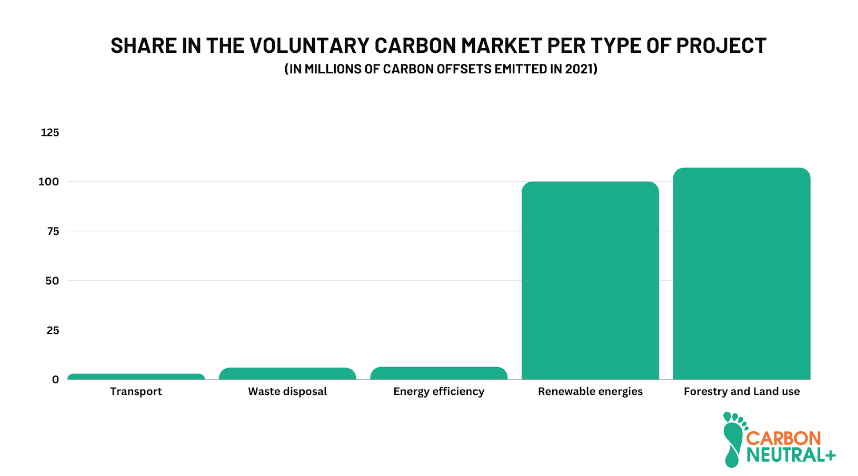

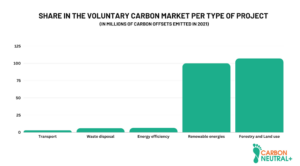

In 2021, 493.1 MTCO2e worth of offsets were retired. This represents an increase of 262% over the previous year. The retirement of offsets through a registry ensures that they cannot be resold.

In terms of distribution by type of project, bonds retired for forestry and land use projects led the market with 46.2%. This was followed by projects promoting renewable energies with 42.9% of the market share.

The voluntary carbon credit market in LATAM

According to the Status and Trends Report on Compliance and Voluntary Carbon Markets in Latin America, published in 2021 by Green Finance, Latin America is the second largest emitter of carbon credits globally, after Asia. Between 2020 and 2021, Latin America was responsible for 20% of the global supply in the voluntary carbon market.

This same report highlights that the countries leading the voluntary carbon market in LATAM are: Brazil, Peru, Colombia, Uruguay and Guatemala. These bonds come mainly from forestry and renewable energy projects.

Brazil accounts for 50% of the global REDD+ and restoration potential, followed by Indonesia and Colombia, both with around 10%. These figures give us an idea of the role the country will play in the coming decades.

Another interesting phenomenon in LATAM has been the emergence of voluntary climate action initiatives supported by governments, such as carbon footprint and carbon neutrality programs.

Carbon credit and climate action initiatives in LATAM

Brazil

Forest + Carbon is a Brazilian program created in 2010 with the goal of promoting forest conservation and restoration strategies to mitigate climate change.

The main objective of Forest + Carbon is to promote the valuation of ecosystem services provided by forests, particularly in relation to nature-based carbon capture and storage.

The initiative is based on a financial compensation mechanism for the environmental benefits generated through forest conservation. The country has around 560 million hectares of native vegetation, which can be valued in the voluntary carbon market due to their potential to reduce deforestation and degradation of native vegetation.

Panamá

Reduce Your Corporate Footprint (RTH Corporativo) is a voluntary program that seeks to encourage private sector actors to manage their carbon footprint.

In addition to establishing a standardized process for calculating the carbon footprint, RTH Corporativo also aims to manage the countrie’s water footprint.

This program also assigns stamps where offsetting is included. Certified and voluntary credits such as Gold Standard and Verra’s Verified Carbon Standard are valid for this purpose.

The basic principles of the voluntary carbon market

The Carbon Core Principles (CCPs) are a global benchmark for high integrity carbon credits.

These principles were developed by the Integrity Council for the Voluntary Carbon Market and set out a number of goals for the disclosure and sustainable development of carbon credits in the voluntary carbon market.

The CCPs were developed from the input from hundreds of voluntary carbon market organizations. They are categorized into 3 groups:

These provide a credible and rigorous means for identifying carbon credits that generate a real and verifiable climate impact, based on the latest science and best practices.

Conclusions

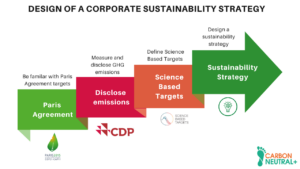

The voluntary carbon market has undergone a remarkable evolution in recent years and has gained importance in achieving the objectives established under the Paris Agreement.

Moreover, they have proven to be an effective mechanism to mobilize private investments towards environmental projects and promote technological innovation in the transition to a low-carbon economy.

The flexibility and decentralized nature of the voluntary carbon credit market allows for the implementation of emission reduction projects that present significant co-benefits. These include biodiversity conservation, sustainable development of local communities and the promotion of clean technologies.

However, it is important to ensure the integrity and transparency of the voluntary carbon market, through the adoption of rigorous standards and certifications, and independent verification of projects. This ensures the confidence of buyers and the effectiveness of emission reduction actions.

CARBON NEUTRAL+ offers its clients Carbon Credits certified under rigorous methodologies such as VERRA. In this way, it ensures the integrity of emission offset projects.

In short, the voluntary carbon credit market is a valuable tool in the fight against climate change, as it complements regulated efforts and promotes the active participation of various stakeholders. Its evolution and continued growth are fundamental to limiting the increase in average temperature and building a sustainable and resilient future in the face of climate change.

CARBON NEUTRAL+ provides comprehensive solutions to measure, reduce and offset carbon emissions through its carbon footprint management platform. In addition, it accompanies companies in the implementation of emission reduction strategies, identifying energy efficiency opportunities and offsetting remaining emissions through verified carbon projects.

Together with CARBON NEUTRAL+, companies can demonstrate their commitment to sustainability and lead concrete actions against climate change.

Carbon dioxide (CO2) emissions generated by human activities have led to an accumulation of greenhouse gases in the atmosphere that is causing an increase in

According to the Emissions Gap Report 2022, the growth rate of global greenhouse gas (GHG) emissions has declined over the last decade. Between 2010 and

As international agreements related to corporate greenhouse gas emissions (GHG) come into force, the regulations associated with the generation of these emissions increase. This is

Climate change is one of the greatest concerns of our time. This phenomenon is generating consequences that are difficult to reverse, such as an increase

The Paris Agreement is an international agreement adopted on December 12, 2015 during the United Nations Climate Change Conference (COP21) in Paris, France. One of

As the world faces the looming effects of climate change, more and more companies are recognizing the importance of adopting sustainable strategies that aim to

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |